Banking & Finance

In a constantly evolving financial landscape, digital transformation is not just an option but a strategic necessity. For many years, banks have made significant investments in technology and innovation, adapting to various tech trends over the past two decades. According to the ABI Lab 2025 report, 66% of Italian banks are increasing their investments in emerging technologies to improve operational efficiency and enhance customer experience. Additionally, the adoption of AI and advanced analytics is becoming a critical focus, with 73% of respondents identifying AI as a top investment priority. This is closely followed by operational resilience and business continuity (68%) and cyber risk management and mitigation (64%). Data remains central to these efforts, with 59% of banks targeting investments and initiatives in Data Governance and Data Valorization.

Grounded in expertise, strategic consulting, and exceptional technological solutions, we partner with banks and financial institutions to help them seize digital transformation opportunities and anticipate the future.

We combine technology with human intelligence, uniting highly specialized professionals to support organic, sustainable, and efficient growth design.

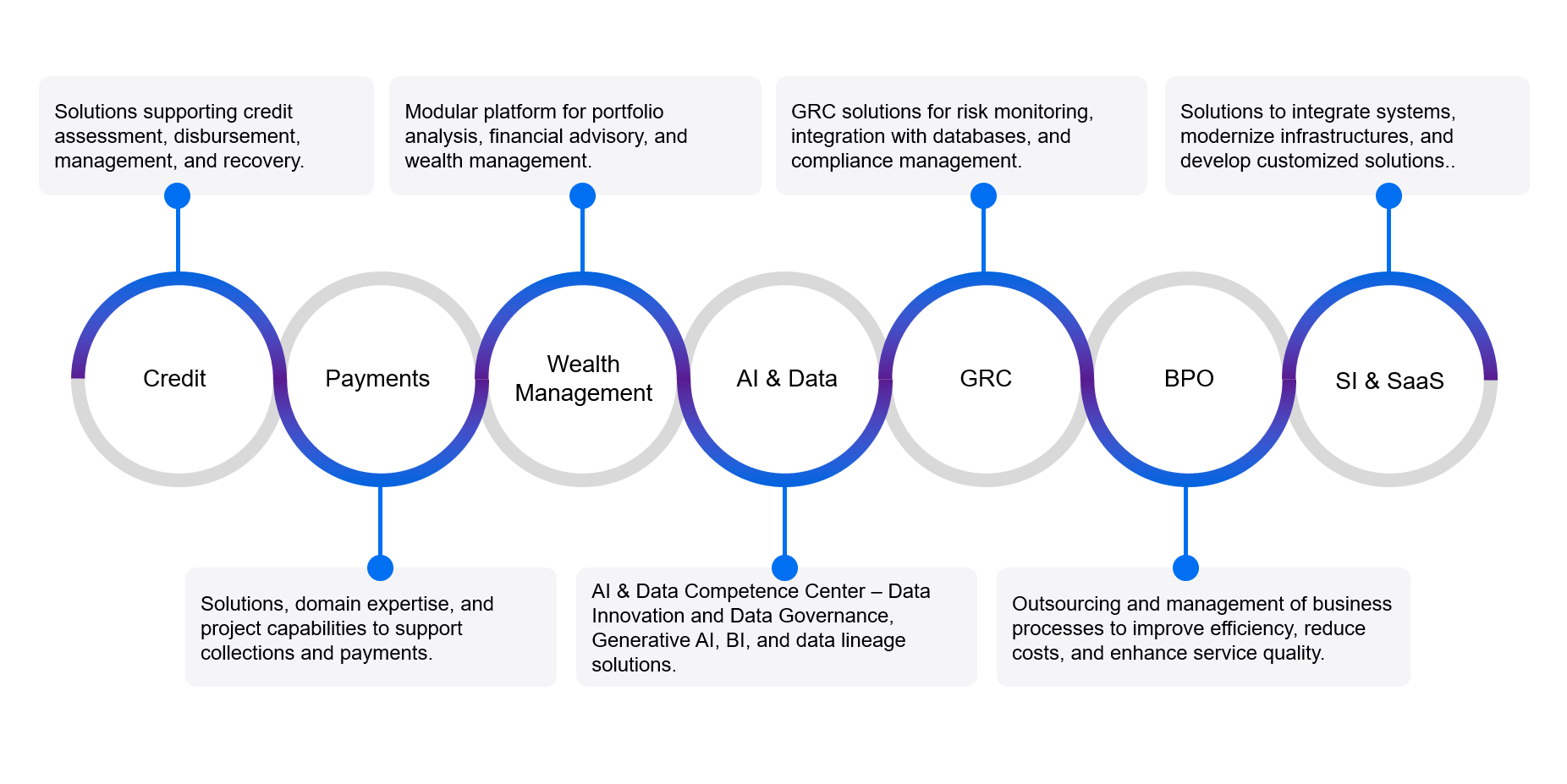

Our focused approach spans seven strategic areas: Credit, Payments, Wealth Management, AI & Data, Governance, Risk, and Compliance (GRC), Business Process Optimization (BPO), and System Integration and SaaS.